does tesla model y qualify for federal tax credit

Ad Electric Efficiency With The Range Of Gas. The bill lifts a tax break cap that excludes EVs made by firms which sell more than 200000 cars per.

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service.

. Which I dont understand because I purchased it when it was and couldnt. Every Model Y would qualify under the new 80000 price cap for SUVs. Electric Vehicles Solar and Energy Storage.

Instead it is an EV tax credit that reduces the federal tax liability on your income. I purchased my Tesla Model Y in late Feb. Electrek noticed that Tesla has increased the price of the Model Y by 1000.

First here are some Tesla vehicles that will qualify for the Tax Credit. 3750 for tax years 2025-26. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit.

It was cut in half again to 1875. Buyers of Tesla and other EVs could be eligible for federal tax breaks under a new Senate deal. Does Tesla qualify for tax credit.

Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100. Youve Never Met a Vehicle that Looks or Drives Like this. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery.

California Clean Fuel Reward for all new electric vehicles registered in California. The Clean Vehicle Rebate Program applies to eligible models ordered on or before March 15 2022 Review eligibility prior to applying. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall.

For instance once Tesla sold 200000 vehicles no matter which model it was the credit was phased out. Tesla and General Motors are the only manufacturers that have reached the 200000-car milestone meaning new purchases of qualifying vehicles from these manufacturers are not eligible for the electronic car tax credit. Bonus add a 5000 Tax credit for Level 5 FSD until.

Ad The Electric Side of BMW. By 2020 the subsidy will be zero dollars for Tesla. It is not a federal rebate.

Then require only new zero emission autos sold after 2050. Learn More About BMW Electric Vehicles Now. The Tesla Model Y doesnt qualify for the 7500 federal tax credit for electric vehicles because the company has passed the 200000-unit.

To qualify for the Federal Tax Credit in a particular year the eligible solar equipment must be. Launch a new 4000 tax credit on sales of used EVs. Compare Specs Of Our Electric Vehicles Like The IONIQ Or KONA Electric Find Yours Today.

Jun 27 2019. Tesla Model Y 179 Deduction. The Tesla Model Y Long Range went up to 58990 from 57990 and.

This would enable Tesla and GM to get access back to the credit though in Teslas case it would only apply to some versions of the Model 3. Various amounts 5500-9500 are available for replacement of an older ICE vehicle with an EV. Since the new law would take the tax credits off the price of an EV at the time of purchase Tesla is making moves to get more money upfront from its customers before getting the rest from Uncle Sam.

Most Tesla products are too expensive to qualify under the new caps. Now when I am filing my taxes through TurboTax it says that the credit is no longer available. Explore Our Alt-Fuel Models Find Yours Today.

That should be fair sales for US buyers and from all auto manufactures sold in the US. The rate is currently set at 26 in 2022 and 22 in 2023. On the website at the time it said there was still a 2000 Federal tax credit available.

The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec. The incentive amount is equivalent to a percentage of the eligible costs. Initially the tax credit was cut in half from 7500 down to 3750.

So now you should know if your vehicle does in fact qualify for a federal tax credit and. Luxury Performance in Perfect Harmony. All of the Tesla lineup models including the Model S Model X Model 3 and Roadster have exceeded the limit.

Tesla reached this mark in July of 2018 so the 50 credit phase out began in January 2019 and ran through the end of June 2019. EV Federal Tax Credit for 2021 Tesla. Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024.

Updated 7292022 Latest changes are in bold Other tax credits available for electric vehicle owners.

Why You Should And Shouldn T Buy The Tesla Model Y

2021 Tesla Model Y Prices Reviews And Pictures Edmunds

Tesla Model Y Exceeds Government Ev Rebate Thresholds Carexpert

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Tesla Model Y Exceeds Government Ev Rebate Thresholds Carexpert

Tesla Model Y Price Jumps Another 1 000 After 2 000 Increase Last Week Fox News

Tesla Increases Price Of Model Y In Canada Delays Expected Delivery Date

Tesla Model Y Car Insurance Cost Forbes Advisor

How Much We Paid For Our 2021 Tesla Model Y J Q Louise

2023 Tesla Model Y Specs And Features For The Best Selling Ev

Used 2021 Tesla Model Y Performance Sport Utility 4d Prices Kelley Blue Book

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Hikes Price Of Model 3 Model Y By 2 000

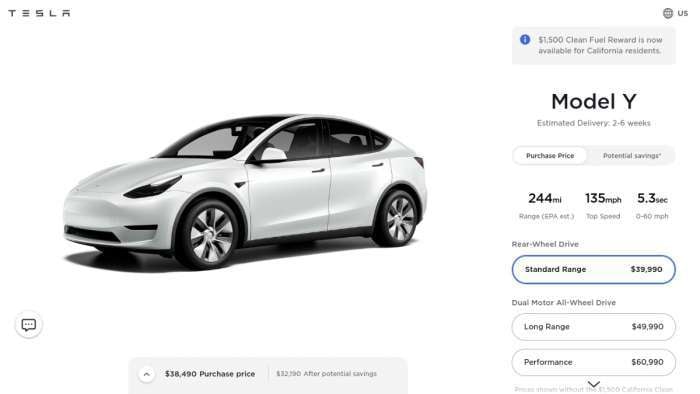

Tesla Model Y Standard Range Available For 39 990 7 Seat Config Released As 3000 Option

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Why You Should And Shouldn T Buy The Tesla Model Y

Is The Tesla Model Y Really Worth 60 000 Will Orders Slow Down